Gold is one of the most stable and reliable protective mechanisms in the securities market. In an investment portfolio, gold can act as an insurance against the risk of inflation and political upheaval, as well as provide portfolio diversification.

Many investors and traders use gold as a protective mechanism in the securities market, especially during periods of economic crises and market uncertainty. At the same time, many analysts are confident that recession is coming soon. And since there is such a possibility and there is a protection mechanism, let’s look at how the price of this protective mechanism (gold) is formed.

What Determines The Price of Gold

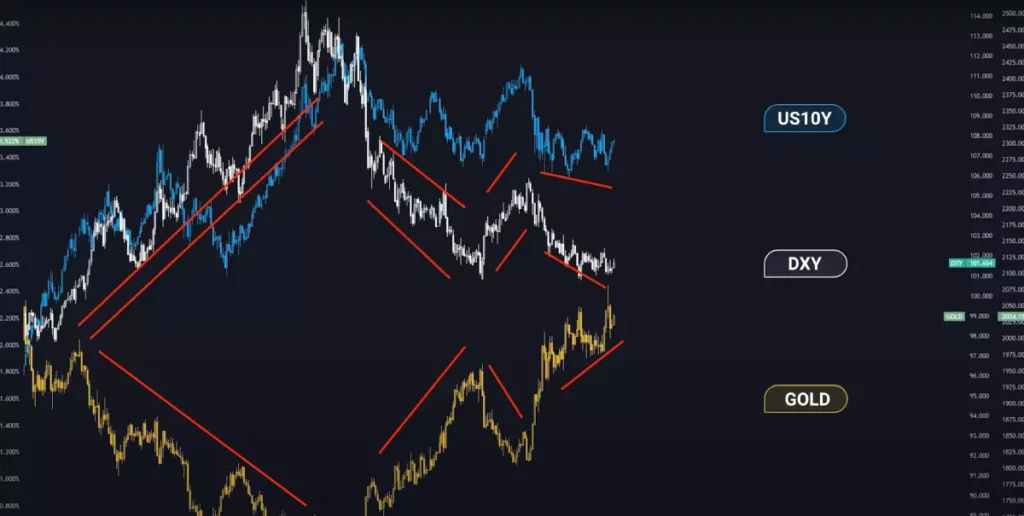

Only two things affect gold:

- U.S. Treasury bond yields

- U.S. Dollar Index (DXY)

And that’s it, nothing more. And gold is inversely related to them. The weakening of the dollar and falling yields are extremely favoured for the price of gold.

When DXY and bond yields rise, gold is under pressure. When one of them rises and the other falls, gold usually takes the side of the one who has grown the most or fell the most. Look at the chart of the last year and see the dependencies.

Moreover, such tendencies work even on longer time intervals. For example, in 2016, when the dollar and yields began to fall at the same time, this led to an instant rally in gold.

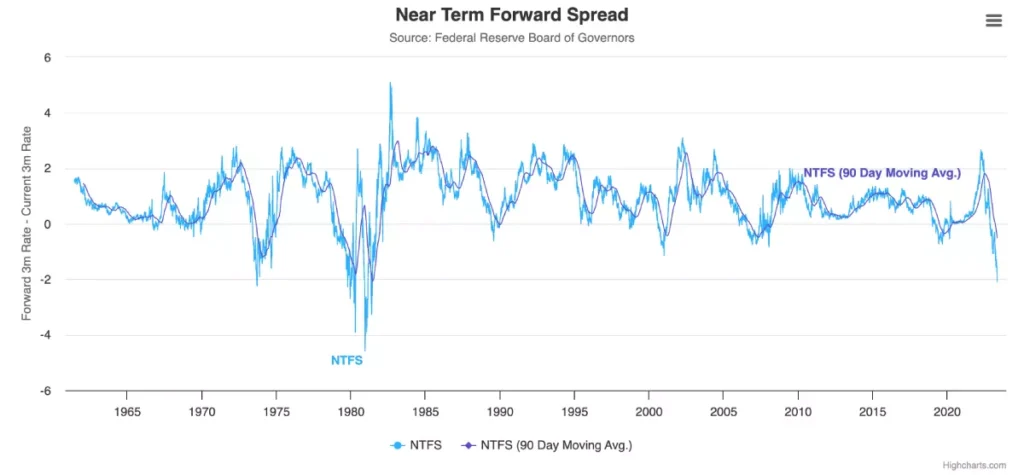

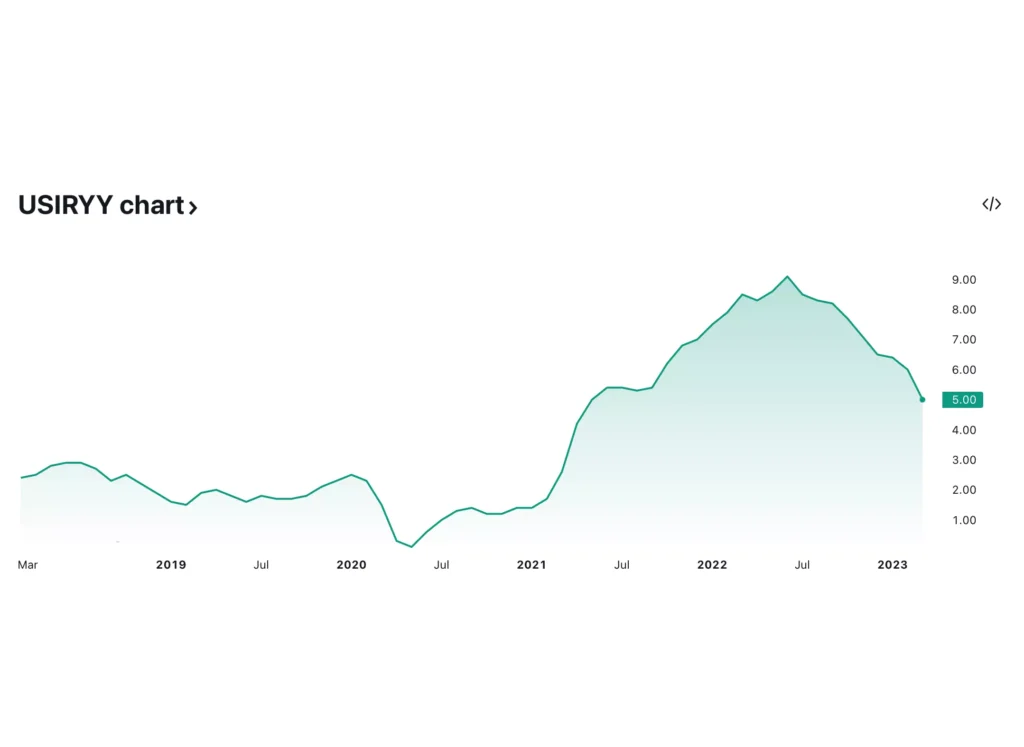

And now everything points to the fact that if the Federal Reserve raised rates sharply over the past year, in the near future the Fed will be forced to turn around. Firstly, the Federal Reserve (with 99% probability) will not raise the rate no more in this cycle. The Fed can only continue to keep it at the same level for some time. And secondly, there’s an indicator that the Federal Reserve itself is looking at. This is the Near Term Forward Spread, which shows the difference between the three-month expected return within 18 months after now minus the current 3-month yield. What does this mean?

Let’s Understand the U.S. Treasury Bond Yields Inversions

Now 3 Month Treasury Bill Rate is about 5%. Market participants suggest that in 18 months there will be 3.5%. So, if 3.5% minus 5% – it turns out -1.5%. The idea here is that bonds up to 2 years directly run the Federal Reserve. If the rate grows and it’s 5%, then the yield on bonds for up to 2 years should be circa 5%. And it should not be lower, because there is also such a phenomenon as overnight repo. The overnight repo yield and rates are approximately at the same level. Overnight repo is a situation where financial institutions park money with the Federal Reserve. And of all the types of transactions in the market, this one is considered the most risk-free.

So, even though US Treasury bonds are the benchmark of reliability, it is still safer to park money at the Fed. And it turns out that if the yield on short-term Treasury bonds were lower or equal to the overnight repo rate, then in theory, to buy bonds not make any sense at all.

The key point

The key point is that two-year short bonds reflect the dynamics of the interest rate. And when we see an inversion, that market participants predict that in 18 months the yield on these bonds will be 1.5 percent lower, then we can say that market participants predict an interest rate cut of at least 1.5%.

Here we have to understand that this indicator is not about exact level of the profitability after 18 months should be, but it determines the direction of the trend in a certain period of time. Jerome H. Powell, the Fed chair, suggested focusing precisely on Near Term Forward Spread.

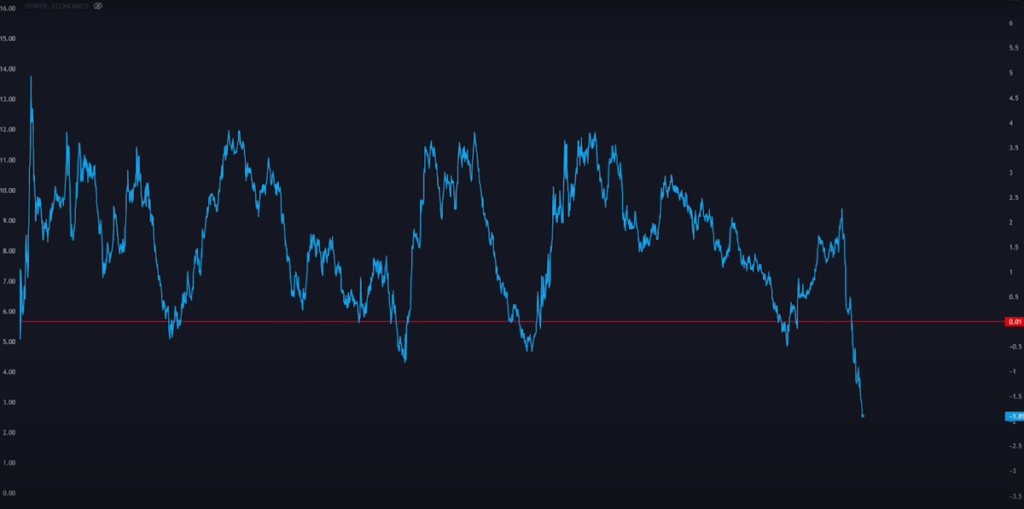

In general, the difference between 10 year and 3 month bonds shows similar dynamics. If there is an inversion, it indicates that the rate on 3 month bonds is higher than that of 10 year bonds. Naturally, this should not happen in a normal economic environment, otherwise what is the point of investing money for 10 years if you can invest it for 3 months and get more.

What Controls the Fed, And Where Is the Reflection of Economic Prospects

3-month bonds are managed directly by the Federal Reserve, but 10-year, 20-year bonds are more about economic prospects.

So it turns out that when the yield on 10-year bonds is lower than on 3-month bonds, this indicates that market participants expect that, although the rate is high now and in the future it will be lower than 3.5%. So this inversion also indicates that in the near future the Federal Reserve will be forced to cut rates very sharply, and the depth of the inversion can be said to have a direct correlation with the rate of future decline.

But this is precisely the paradox that everyone understands perfectly well that in the near future the rate will start to fall, but at the same time it will not start doing this until some kind of collapse occurs.

Why Would the Federal Reserve Keep DXY High

The Fed may try to keep the DXY high to keep the dollar in high demand during the turmoil. Plus, if there is a panic in the stock market, then this can traditionally also lead to a flight into the dollar. This is because the shares are selling just in exchange for the dollar, and this at the moment can also be a factor in favour of the strengthening of the dollar. Therefore, at some point, help for the market may not come in time.

An Example of Reducing Oil Production to Maintain Prices

It would still make more sense for the Federal Reserve to act now in the same way as Saudi Arabia acted at the end of March, 2023. Recall how they drastically cut oil production in addition to the cuts they made last fall. And then at the moment the oil shot up very strongly.

Objectively speaking, they didn’t want to make something bad for Joe Biden, who asked them not to cut the production. Or they did it not because the Saudis became very friendly with Russia. They cut oil production simply because they knew perfectly well that due to the slowdown in world economic activity, demand for oil would continue to fall. And that’s f—ing it!

READ ALSO

Inflation Is Cooling but There Are Still Many Concerns

The idea of the Saudis was to push the prices up. So, in the context of the Fed, when we talk about saving the dollar and maintaining its attractiveness as a world reserve currency, it will be a similar attempt to keep the dollar above the level of 100 as long as possible. Anyway we will find out soon whether the world community agrees or disagrees with such a policy. Because the struggle for 100 level is becoming more and more obvious.

Long-Term Outlook for Gold

Long term for gold? Well, it is one of the few assets that looks very attractive. Bond rates will be lowered. And in the end, maybe not this year, but we will see it again at zero. The fact is that in a different way it simply will not be possible to service such an amount of debt in the system. Servicing Treasury debt alone now costs about $1 trillion a year or so.

Thus, a fall in the rate opens up a crazy potential for gold growth. The same goes for DXY. In the long term, the dollar will in any case become cheaper, which will be extremely favourable for the growth of the price of gold.

If you are a long-term investor, if you can afford to be in a position for months or even years, then Gold is the tool for you. And now is the right time to increase your position in gold. If you still have dreams that gold will someday cost 1.200 – 1.400 points – well, there’s bad news for you. Those days are gone, forever.