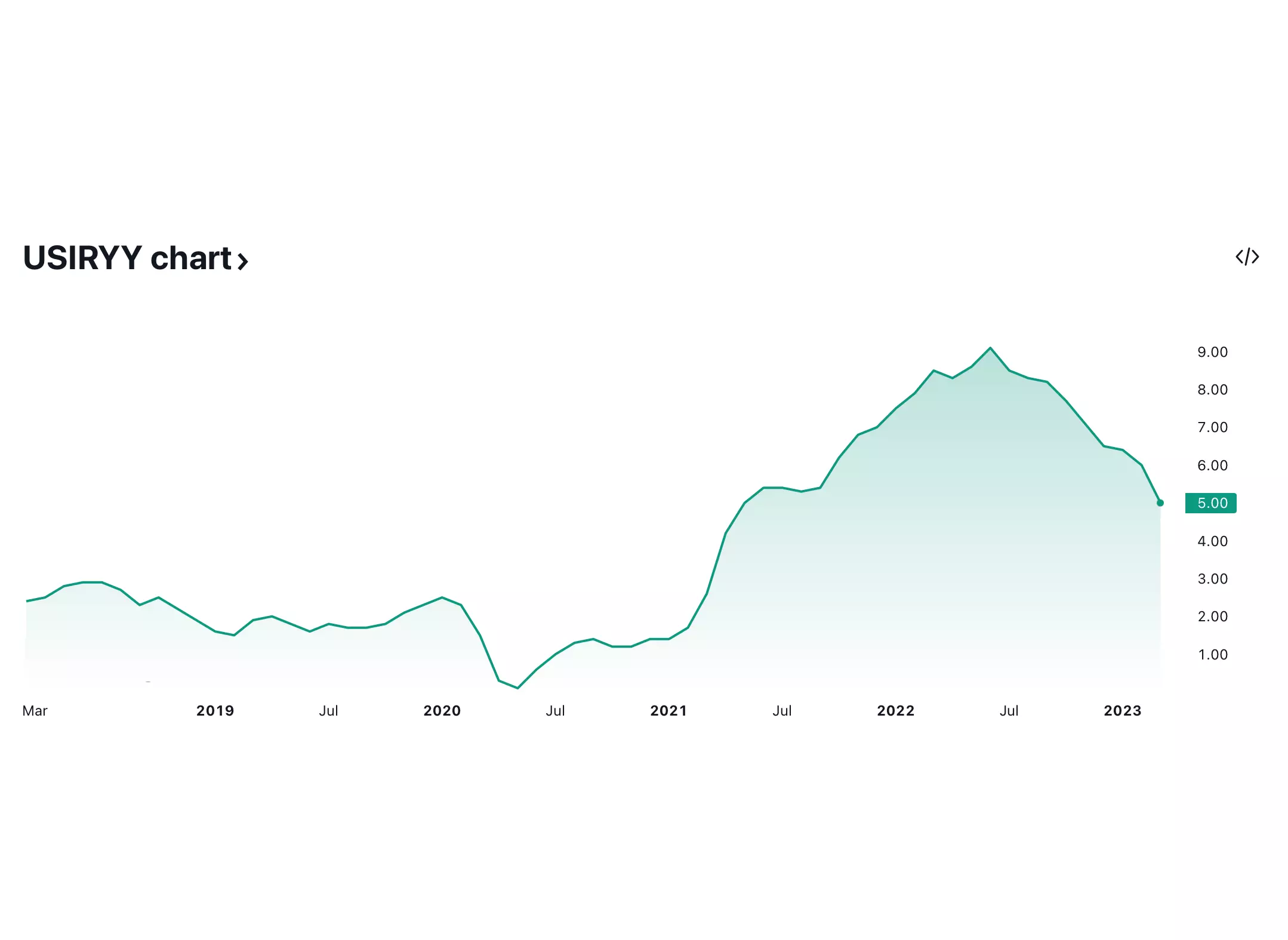

Consumer prices increased 5 percent in March, up from 6% in previous month. It is the best result since May 2021. This is indeed a significant 📉 slowdown. But there are details in the report that make it difficult for the Fed to move forward on interest rates.

Yes, inflation has noticeably cooled down. Energy prices, including the oil and gasoline, significantly contributed to this trend, reducing the degree of tension for many Americans. It was a good opportunity for Biden to deliver a positive message.

However, if we look closer at the report, it is clear that not all categories of goods are cooling. This adds to the uncertainty about whether the cooling in inflation is a sustainable trend.

Ambiguity of the situation

However, the inflation cooling is a pain in the ass for the Fed. The overall picture of inflation is very blurred, and different sectors of the economy are moving in different directions. For example, energy prices of all kinds fell rapidly. However, airfare prices skyrocketed. Transportation services are also on the rise. And as we know, OPEC decided to cut oil production, which again pushes energy prices up.

And although there is significant progress and inflation is cooling from a peak of 9% almost a year ago, the process is very slow. It looks like the path to 2%, which was the norm before the Covid in 2020, will not be reached anytime soon. And while Fed is aiming for 2% inflation, there are unconfirmed rumors that 3% is a viable option, at least for the nearest future.

In an attempt to bring inflation to the required level, some central banks have suggested that the Fed officials may have to raise interest rates by another quarter of a point. Inflation data came in slightly better and it gives the Fed that possibility.

What can get in the way

The president of the Federal Reserve Bank of Chicago, says that because of some banks bankruptcy it becomes harder to get access to credits which slows economy and increases risks for business to fail. It’s betting for expensive to borrow the money when the interest rate is high. As demand cools and the labor market softens, wage growth also softens. Possibility of recession s getting higher and higher with every increasing of interest rates.

Markets rise on this news

On this news, the share price jumped, the S&P 500 is also rising. But government bond yields are falling. Many investors completely ignore the fact that a possible increase in interest rates could trigger a recession, which will lead to a significant decrease in the value of shares. For investors, the victory over inflation is a positive signal, but if the Fed overdoes it, then optimism will change to negative in one moment.