The enthusiasm around crypto is deflating. There are no heated discussions on the topic of what kind of technology this is, whether the cryptocurrency will replace fiat money, how much was invested in the next crypto-idea. The noise has subsided, the dust is dissipating, the real application of cryptocurrencies, unlike blockchain technology, has not been found.

Yes, cryptocurrencies have generated incredible hype, attracting the attention of both investors and the public. In a short period of time, some of them have reached unprecedented heights, attracting many people who dream of making quick and easy money. However, as the history of markets shows, every bubble inevitably deflates. Perhaps the crypto bubble is also coming to an end. And yes, it’s a bubble. After all, hardly anyone will deny the fact that we have experienced a market situation in which the market price of an asset was significantly and unreasonably overstated.

For this asset class, the period of time in which we are now is commonly referred to as the cryptocurrency winter. From the very beginning of the emergence of bitcoin, he moved the prices of other crypto assets up and down. The basis for this was halving of the reward for mining blocks. And each time the reward is getting smaller, and the momentum of the price movement up is getting weaker.

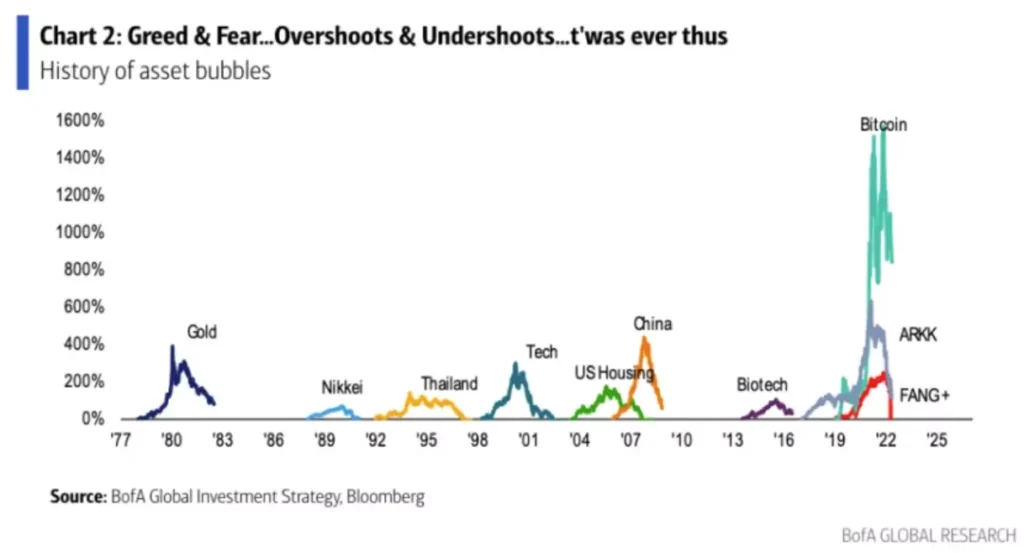

Comparison of Financial Bubbles

Looking at past major financial bubbles, we face a few common features. They were characterized by huge increases in asset prices in a relatively short period, in many cases accompanied by euphoria and unbridled enthusiasm. Examples are the dotcom bubble in the late 1990s, the US housing market before the 2008 financial crisis. Both were prominent and long-lasting, drawing masses of individuals before eventually bursting.

On the chart below, you can see other bubbles in the history of recent decades. All of them were blown away, enriching some and impoverishing others. But it is worth recognizing that the crypto bubbles has become the largest. And as we know, the higher you climb, the harder it is to fall.

According to calculations, the depreciation of cryptocurrencies is now competing with both the dot-com collapse and the subprime mortgage crisis. Looking at the charts, we may find that in the early 2000s, Nasdaq lost 73% from peak to trough, and bank stocks lost 78% during the Great Financial Crisis of 2008 and 2009.

However, cryptocurrencies have their own characteristics. If tech and banks continue to develop, providing real benefits, then cryptocurrencies still do not have a wide real application. And even as some businesses and stores have begun accepting bitcoin and other coins as payments, their use remains relatively limited. Keeping money in a volatile market is risky, and the chances of another rapid growth, as described above, are less and less.

Most people still can’t use cryptocurrencies in everyday life as easily as regular national currencies. These limits mass adoption of this technology and raises doubts about their long-term stability.

Financial bubbles are being replaced by others. Will AI be next?

It is possible that a new hype may come to replace the crypto bubbles, and there are all signs of a new one in artificial intelligence (AI) companies. In recent years, companies developing AI-based technologies and products have attracted increasing attention from investors and the public. They promise to revolutionize industries including medicine, automotive, finance, and more.

Many of them are attracting huge amounts of investment and their value is growing faster than their actual income. Sounds familiar? This is reminiscent of the situation with cryptocurrencies and their rapid rise. Some experts warn that AI firms could become the next financial bubble, where stock prices no longer meet fundamentals.

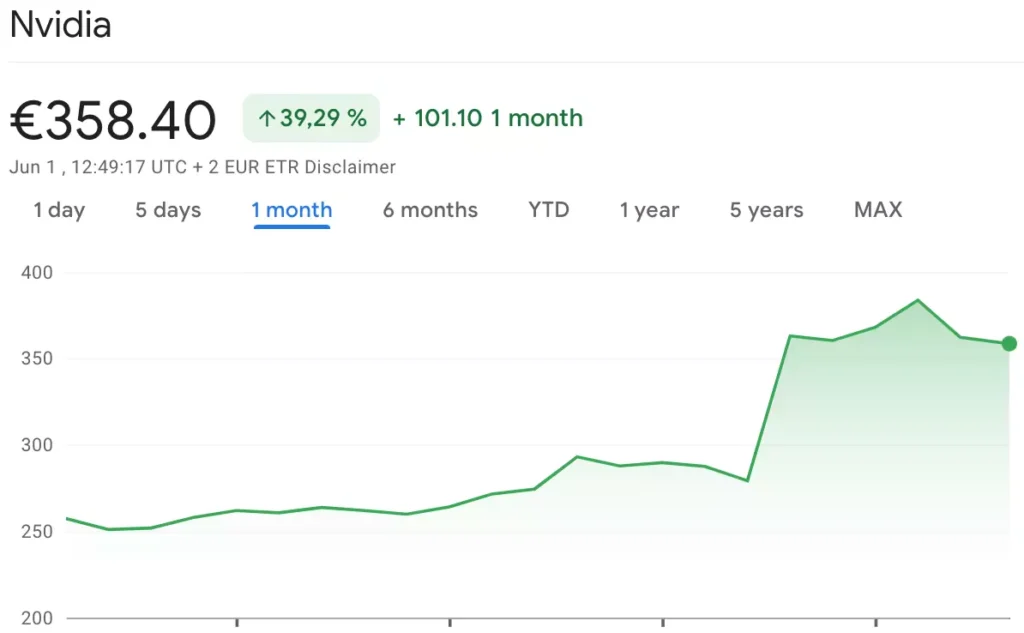

One of the signals can be called a sharp jump in the value of Nvidia shares. Nothing like this has happened in the last few decades. Suddenly, everyone suddenly realized that AI is the future and this flywheel is just starting to unwind. The company’s outlook in the latest report was good, the prospects are bright. the problem is that now the whole world is looking at these prospects and is ready to buy everything related to AI in the hope of capitalizing on the trend.

Media attention

Around AI is the strong hype and media attention they attract. AI-powered products and technologies promise to change the world, and investors are eager to be part of this transformation. However, similar to cryptocurrencies, many of them do not show real profits or fundamental indicators that confirm their value.

Reassessment of potential

Another reason for the emergence of a new hype is the overestimation of the technological potential of AI. While AI has great potential, its full implementation may take much longer than some investors expect. Some startups and businesses may be overvalued based solely on expectations and hypothetical AI potential, which may lead to frustration and lower value.

Read also: Every macOS from Mojave to Ventura Has Bitcoin Whitepaper

The importance of AI and its future in the tech world can’t be denied. However, it is important to be aware of the potential risks and warn against repeating the mistakes of the past. Investors and the public should be cautious and critical of AI companies before investing. It is necessary to conduct a thorough analysis of fundamental indicators such as earnings, profitability and growth potential before making investment decisions.

Summarize

While cryptocurrencies can expect a decline in their popularity and value, they are not going anywhere. It looks like this asset is with us forever. Only the capitalization of cryptocurrencies is in question. Will this industry be valued at trillions of dollars, or will it become a niche industry for a group of enthusiasts.